Understanding the difference between retail and institutional trading is the first step to making smarter decisions in the financial markets. While both types of traders operate in the same markets, their behavior, strategy, risk management, and influence are vastly different.

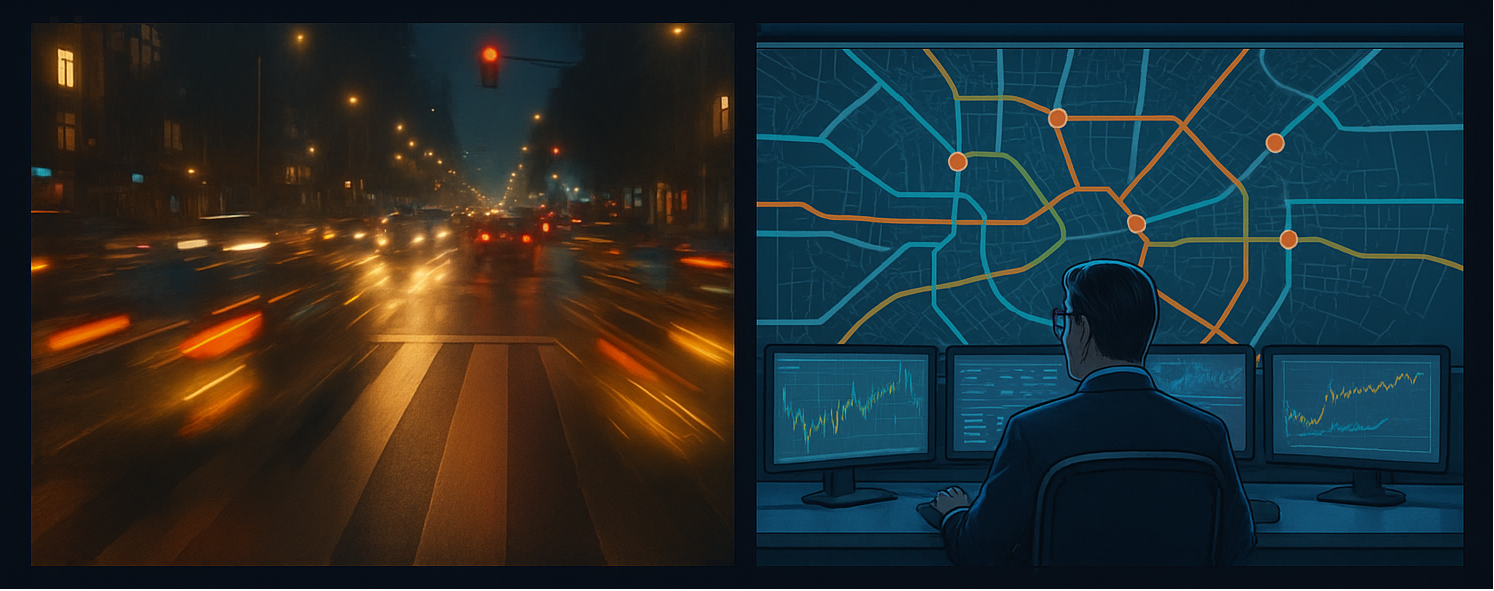

In the image, the left side reflects the retail trading world — chaotic, noisy, and emotionally driven. It’s like navigating traffic in a fast-paced city at night. Every trader (or vehicle) is reacting impulsively to signals — moving with haste, often without a clear destination. Retail traders rely on indicators, breakouts, and news flashes, often overwhelmed by noise and randomness. It’s reactive, scattered, and full of uncertainty.

In contrast, the right side represents the institutional trading ecosystem — calm, calculated, and data-driven. Just like a command center overseeing the entire city grid, institutional traders operate from a higher vantage point. They use precise algorithms, advanced infrastructure, and strategic mapping to see patterns invisible to the retail eye. Their decisions are not driven by emotion or trend-chasing — they’re based on control, logic, and deep analysis.

Retail traders are individuals trading with personal capital through platforms like Zerodha, Robinhood, Binance, etc. They often rely on online research, news, technical indicators, and social media for guidance. Their access to capital, information, and execution power is limited, making them vulnerable to market traps set by smarter players.

Institutional traders represent entities like hedge funds, investment banks, pension funds, or proprietary trading firms. They use large amounts of capital, sophisticated algorithms, and insider-level data. Their strategies are designed around market psychology, volume absorption, inventory distribution, and risk-reward optimization at scale.

| Aspect | Retail Trader | Institutional Trader |

|---|---|---|

| Capital | $500 to $50,000 | Millions to Billions |

| Tools | Indicators, News, TradingView | Proprietary Tools, Order Flow, Volume Profile |

| Mindset | Greed & Fear Driven | Structured, Psychological Edge |

| Strategy | Random entries based on indicators | Price Action, Inventory Analysis, Risk Allocation |

| Risk Management | Often ignored | Pre-defined, data-driven |

| Success Rate | 5-10% | Consistently Profitable (60-80%) |

| Execution | Manual via apps | Smart Order Routing, Dark Pools, HFT |

| Psychology | React to market | Control the market |

We bridge this gap. At Trade Institutional, we don’t just teach; we transform. We train retail traders to think, plan, and execute like institutions. Our institutional-grade curriculum includes:

Most retail traders lose because they’re playing an institutional game with retail tools. We change that. Forever.

Don’t just trade. Trade Like Institutions.

Apply Now for institutional transformation.