Institutional Trading represents the highest echelons of Market engagement. Unlike Retail traders, Institutions Trade not for short-term gains, but for influence, control, and long-term Capital appreciation. Their trades can move markets, shape trends, and create narratives. This chapter introduces you to the mindset, structure, and goals of Institutional Traders - the 'smart money' that operates behind the scenes. We'll explore why their methods differ, how they develop strategies, and how understanding these can give you a trading edge.

Understanding the difference between Retail and Institutional Trading is the first step to making smarter decisions in the financial markets. While both types of traders operate in the same markets, their behavior, strategy, risk management, and influence are vastly different.

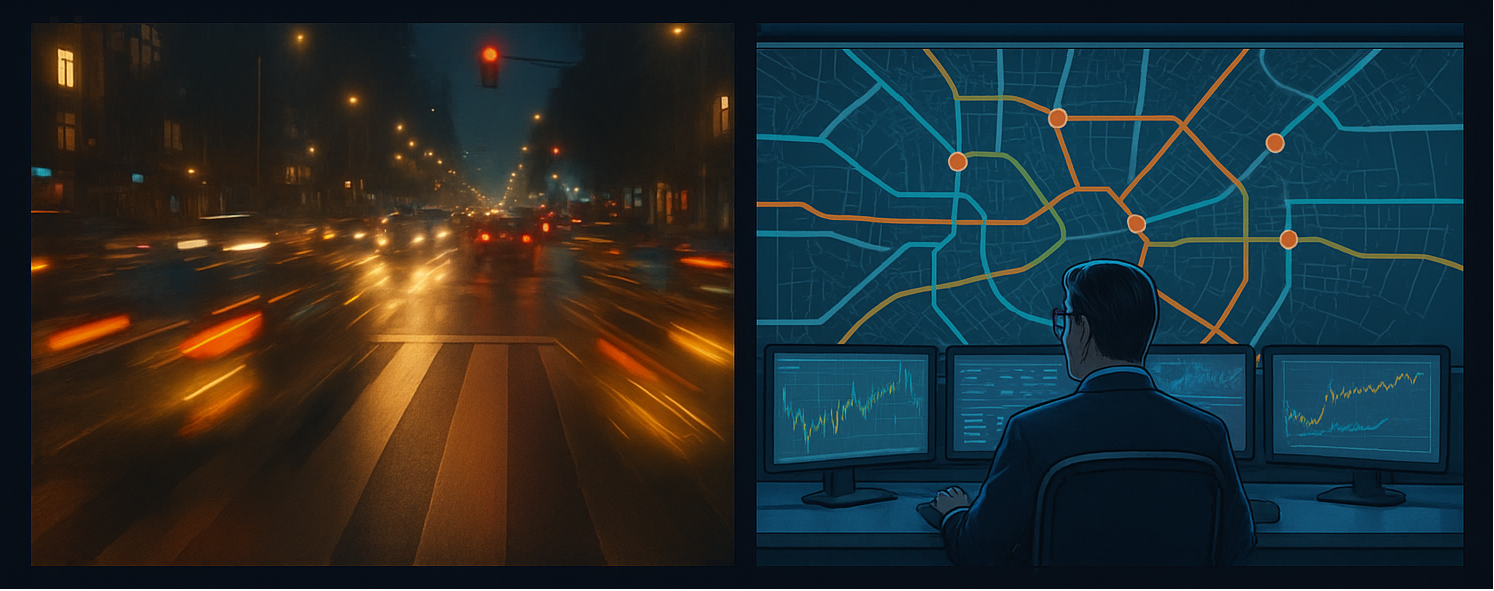

The left side symbolizes the chaotic nature of retail trading — loud, emotional, and reactionary. It’s like being trapped in dense city traffic at night. You’re stressed, rushing to get somewhere, and your entire attention is locked on the red and green traffic lights. Red means stop, green means go — no room for thought, just reaction.

This mirrors retail traders watching candlesticks: red triggers fear, green triggers greed. You’re moving not with a plan, but with pressure — from markets, news flashes, and often your own stress. Just imagine getting a call from home during that traffic jam — your frustration spikes, your decisions get even worse. That’s what retail trading feels like when it’s ruled by emotion.

Retail traders rely on signals — indicators, breakouts, charts — but without a roadmap. They move fast but rarely with intention. It’s impulsive, scattered, and dominated by noise. Not strategy.

The right side symbolizes the elite domain of institutional trading — a world of strategy, foresight, and total control. While retail traders are stuck inside the traffic, frustrated by red lights and reacting moment-to-moment, institutions are seated high above in the control center — orchestrating the entire grid with surgical precision.

They see what others can't. With access to vast data networks, quantitative models, and high-speed infrastructure, they don't chase markets — they design them. While a retail trader anxiously waits for a green light, the institutional trader is programming the timing of those lights based on probability, liquidity flow, and macroeconomic rhythms.

It’s not just about tools. It’s about perspective. Institutions move with intent. They anticipate instead of react. Their strength comes from discipline, capital structure, and a deep commitment to planning. Every trade is mapped, every move is calculated, and every decision is embedded in logic and long-term vision.

In this world, emotion is eliminated — not because they’re better humans, but because they’ve built systems designed to protect them from their own impulses. Where retail trading feels like chaos, institutional trading feels like command. One is traffic. The other is architecture.

| Aspect | Retail Trader | Institutional Trader |

|---|---|---|

| 1. Capital Base | $1000 – $100,000 (Self-funded) | Millions to Billions (Fund-backed) |

| 2. Tools Used | Lagging Indicators, News Tips & Retail Platforms | High-Precision Complex Methematical models, Superior Price Action tools, Order Flow Systems, Analytics Suites |

| 3. Mindset | Emotionally reactive (FOMO, fear, greed) | Calm, Structured, Rules-based mindset |

| 4. Strategy | Indicator-focused, impulsive entries | Inventory, Liquidity, and Probability-driven setups |

| 5. Risk Management | Rarely defined, often ignored | Pre-planned, deeply integrated |

| 6. Consistency | Low — < 10% sustain profits | High — designed for long-term sustainability |

| 7. Execution | Manual orders via apps | Smart Routing, HFT systems, Dark Pools |

| 8. Market Influence | React to price movement | Shape or anticipate Market moves |

| 9. Education | Social media, YouTube, self-taught & Retails Courses - invest Less on Eductions | Formal training, Quant Research & Institutional Experience - They love to invest on Tools and Reseach Heavily |

| 10. Data Access | Delayed or basic data | Real-time Level 2, Volume Profile, Institutional Flows |

| 11. Emotional Resilience | Heavily affected by Profits/Losses | Process-focused, Emotionally Neutral |

| 12. Trade Planning | Trade first, think later | Plan the Trade and Trade the Plan |

| 13. Market Entry, Exit & Stop Loss | Easily Predictable and visible | Entry and Exits are Invisible to outer World |

| 14. Vocabulary & Terminology | Buy, Sell, Resistance, Support | Long, Short, Close, Accumulation, Distribution |

| 15. Focus | Profit and Loss | Edge (Statistical Advantage) and Hedge (Capital Protections) |

| 16. Discipline & Confidence | Lacks discipline; easily shaken by results | Highly disciplined with rock-solid conviction in strategy |

| 17. Probability & Risk-to-Reward | Rarely considers RRR or win probability; trades are emotionally driven | Every trade is filtered through Risk-to-Reward ratios and statistical probability |

Institutional trading represents the apex of capital deployment—where colossal financial powerhouses such as hedge funds, sovereign wealth funds, pension giants, investment banks, and global insurance conglomerates execute transactions of extraordinary scale and strategic nuance. These entities manage portfolios valued in the billions, entrusted with the stewardship of capital that must be allocated with surgical precision, unwavering discipline, and a long-term vision that transcends market noise.

Unlike retail participants who often respond to market sentiment or transient headlines, institutional investors operate within a rigorously structured ecosystem. Their decisions are meticulously crafted through the interplay of specialized analyst teams, proprietary data intelligence platforms, and fortified risk management protocols designed to safeguard assets and optimize returns in an ever-evolving market landscape.

Definitive pillars that characterize institutional trading include:

Institutional trading is the commanding force behind the intricate choreography of global financial markets. Gaining a profound understanding of these sophisticated operators is essential for those who aspire to transcend retail limitations and operate with a truly institutional caliber of insight and influence.

Institutional investors do not rely on basic indicators or short-lived technical patterns. Instead, they employ sophisticated, multi-layered strategies that span asset classes, timeframes, and geographies. These approaches are deeply data-driven, supported by robust research, risk management, and precision execution.

Here are some of the most commonly used institutional strategies:

1. Global Macro Strategy – Institutions trade based on broad macroeconomic trends, such as interest rates, inflation, central bank policies, and geopolitical developments. These positions often span currencies, commodities, fixed income, and equities to reflect a global economic thesis.

2. Event-Driven Strategy – This strategy seeks to capitalize on market inefficiencies caused by corporate events like mergers and acquisitions, earnings announcements, restructurings, or bankruptcies. It is commonly used by hedge funds specializing in merger arbitrage and special situations.

3. Quantitative Trading – Quant funds rely on algorithms, statistical models, and AI to detect patterns and execute trades at scale. This includes strategies such as high-frequency trading (HFT), momentum-based models, and predictive analytics that process large datasets.

4. Statistical Arbitrage – Using quantitative models, institutions exploit pricing discrepancies between related financial instruments. This typically includes pairs trading and mean-reversion strategies, executed rapidly and repeatedly to capture small inefficiencies.

5. Smart Money Concepts (SMC) – This strategy focuses on identifying institutional footprints in the market by analyzing liquidity zones, order blocks, stop hunts, and trap zones. The goal is to align with the market flow created by large players rather than follow retail sentiment.

Each of these strategies requires coordinated efforts between analysts, portfolio managers, execution specialists, and risk managers to ensure success in dynamic and competitive markets.

In the high-stakes world of institutional trading, success hinges on access to technology and data far beyond the reach of conventional retail platforms. These elite tools are meticulously engineered to deliver unrivaled market intelligence, precision execution, and anticipatory insights—transforming market complexity into actionable clarity.

The considerable investment in these platforms is justified by the unparalleled informational advantage and strategic precision they confer—defining the boundary between institutional dominance and retail uncertainty.

Within the halls of institutional finance, risk management transcends mere protocol—it is the cornerstone of capital preservation and strategic decision-making. Every trade undergoes rigorous scrutiny through a multi-dimensional risk architecture designed to safeguard assets and optimize returns.

Fundamental pillars of this elite risk management framework include:

Institutional risk committees wield decisive veto authority, ensuring that capital allocation aligns unwaveringly with strategic risk tolerance and the uncompromising mandate of capital preservation.

Institutional investors approach portfolio construction with a strategic vision spanning decades, prioritizing enduring value and stability over transient market movements. Their portfolios are architected to align seamlessly with the fund’s overarching mandate—emphasizing resilience, diversification, and sustainable growth.

Foundational pillars of their disciplined portfolio strategy include:

This methodical, patient approach forms the bedrock of success for iconic investors like Warren Buffett, sovereign wealth funds, and global pension giants, whose capital stewardship has spanned generations.

At Trade Institutional, we don’t merely educate — we elevate. We bridge the gap between retail and institutional finance by transforming everyday traders into disciplined, strategy-driven professionals. Our programs are engineered for one purpose: to align your mindset and execution with the standards of institutional excellence.

Too much noise out there. Decide — follow the crowd or go against it with clarity.

If you want to trade on Institutions level, you must move beyond indicators — and into the science of market psychology, structure, and controlled execution.

Most retail traders lose because they’re playing an institutional game with retail tools. We change that. Forever.

Don’t just trade. Trade Like Institutions.

📱 Chat on WhatsApp | 📧 Apply Now

TradeInstitutional.com

Market Decoded. Strategy Delivered. Institutions Unlocked.